Company Registration

How to choose Limited Company or Company Limited By Shares ?

Usually there are 2 types company to choice when setup a company in Taiwan, here is the core difference :

Limited company:

- Company operating by all shareholders.

- Final liquidation responsib by all shareholders.

- Each shareholder has one voting rights.

- Allow change company type to Company Limited by Shares.

Company limited by shares:

- Company operating by Board of Directors

- Final liquidation responsib by all directors.

- Each share have one voiting rights.

- Not allow to change company type.

Few founders and they will operating company togeter, should set up Limited company. Many founders and few operating company should set up company limited by shares.

What laws need to be comply when operating a company in Taiwan ?

- Company Act

- Statute For Investment By Foreign Nationals (if sharehoder is a foreigner)

- Value-added Tax Act

- Income Tax Act

- If hiring empoyees

- F&B business

How to fully protect my company name ?

To fully protect your company name, there are 4 databases should be registered. You may proceed pre-check the name you want to register from 4 databases in advance, make sure the name is unique and registerable in evey databases, then register step by step.

Here are pre-check links for 4 databases:

1. Chinese company name: <Link>

2. English company name: <Link>

3. Domain name: <Link>

4. Tradmark: <Link>

Taxation

What should I pay attention to when setting up a company in Taiwan?

After the company is established, you will need to declare the following taxes

1. VAT- Value-added tax (basic tax rate is 5%)

Before companies proceed a dissolving(*deregistration*) or apply for business temporarily closed. All companies must declare the VAT to tax authority.

Regardless of whether companies have income or expenses, shall declare it before the 15th of each odd month.

The contents of the declaration are income and expenses in previous two months.

(For example: Jan and Feb income or expenses will be declared in Mar before 15th)

2. Company corporate tax (tax base rate is 20% of 2021)

The tax year in Taiwan runs from 1 January to 31 December. The company must work out the year's profit and loss for a previous year in May of the next year. And declare and pay it by the end of May in the current year.

3. Provisional payment: If the company has paid corporate tax for profit in the previous year, half of the previous year's tax shall be paid by the end of September in the current year

4. Withholding tax declaration: If the company has paid to individuals in the current year, such as, commission or salary etc., it must be declared before the end of January of the following year.

How should the company declare its domestic/foreign income?

1. Domestic income:

The GUI(Government Uniform Invoice) is a standard VAT invoice. In Taiwan, all companies need to purchase GUI books. Whenever companies selling goods or services must issue a GUI to a purchaser at the time of sale, delivery, or receipt of payment.

- If customers are individual, you must issue Duplicate uniform GUI Books

- If customers are a company, you must issue a Triplicate uniform GUI Books

(For example: for January income, you need to purchase a GUI Book for January and February, and declare the VAT before 15th Mar.)

2. Foreign income:

- By exporting goods:an export declaration must be provided

- By providing the provision of labor services:contracts, INVOICES, and inward remittance slips must be provided.

What should I pay attention to when the company pays?

If the seller is a company:

The seller should issue a Triplicate uniform invoice with the company’s uniform number.

If the seller is a store

The company should receive a receipt from the seller.

If the seller is an individual

The seller must provide his/her personal information, Please note that if any withholding taxes and second-generation health insurance need to be declared.

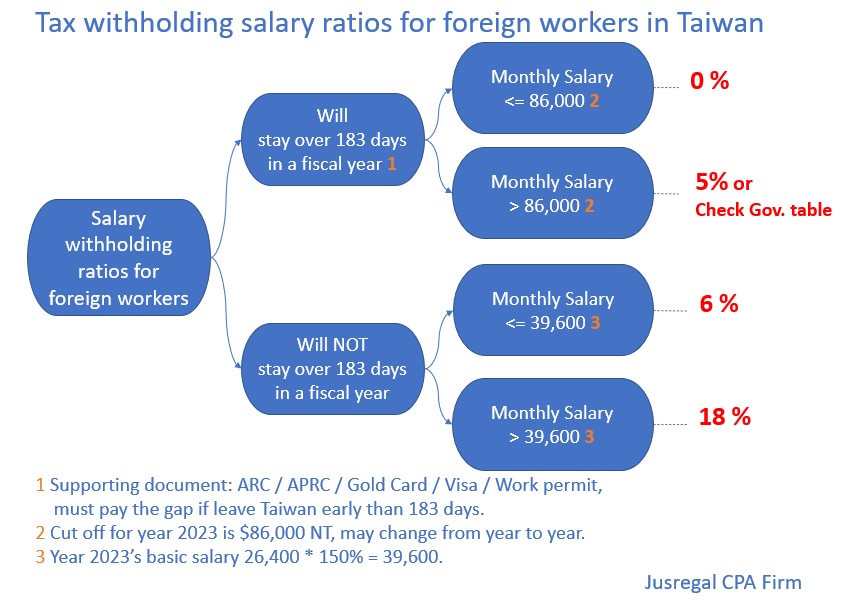

What are the differences between Tax Residents and Non-Tax Residents?

|

|

Taiwan tax resident Stay >=183 days in Taiwan |

Non-Taiwan tax resident Stay < 183 days stay in Taiwan |

|

Taiwan source income |

|

|

|

Offshore income |

|

|

Immigration

When can I apply for APRC (Alien Permanent Resident Certificate) in Taiwan?

- Principle:

- Continually stay in Taiwan for 5 years and stay 183 days in Taiwan each year.

- Exceptions:

- A foreign regular professional: continually stay in Taiwan for 5 years and stay an average of 183 days in Taiwan each year.

- A foreign special professional (include gold card): continually stay in Taiwan for 3 years and stay an average of 183 days in Taiwan each year.

- A spouse or foreign regular professional: 5 years after your spouse got an APRC, and you continually stay in Taiwan for 5 years and stay an average of 183 days in Taiwan each year.

- A spouse or foreign special professional: 3 years after your spouse got an APRC, and you continually stay in Taiwan for 5 years and stay an average of 183 days in Taiwan each year.

For a gold card holder, what is the difference in the tax issue?

Mostly the same, only one difference is there is a benefit for those gold card holder who received TWD 3,000,000 salaries from Taiwan.

- Conditions:

- Has been approved for the first time to reside in Taiwan for the purpose of work.

- Does not have Taiwan household registration in a fiscal year before 5 years.

- Does not resident in Taiwan over 183 days in a fiscal year before 5 years.

- Has engaged in professional work related to special expertise recognized by the relevant central competent authority in Taiwan.

- Satay in Taiwan over 183 days in the fiscal year.

- Professional working salary income from Taiwan employer over 3,000,000 TWD.

- Tax Benefit:

- The part of salary income over 3,000,000 TWD is 50% tax-free.

- Overseas income is all tax-free.

- Benefit for 5 years.

JusRegal CPA Firm & Immigration Consultant - Taiwan

JusRegal CPA Firm & Immigration Consultant - Taiwan